open end lease accounting

Last beyond the current accounting. An open-end lease containing a 12-month term that then goes month-to-month would require 12 months of payments on the balance sheet.

Operating Lease Accounting For Asc 842 Explained W Example

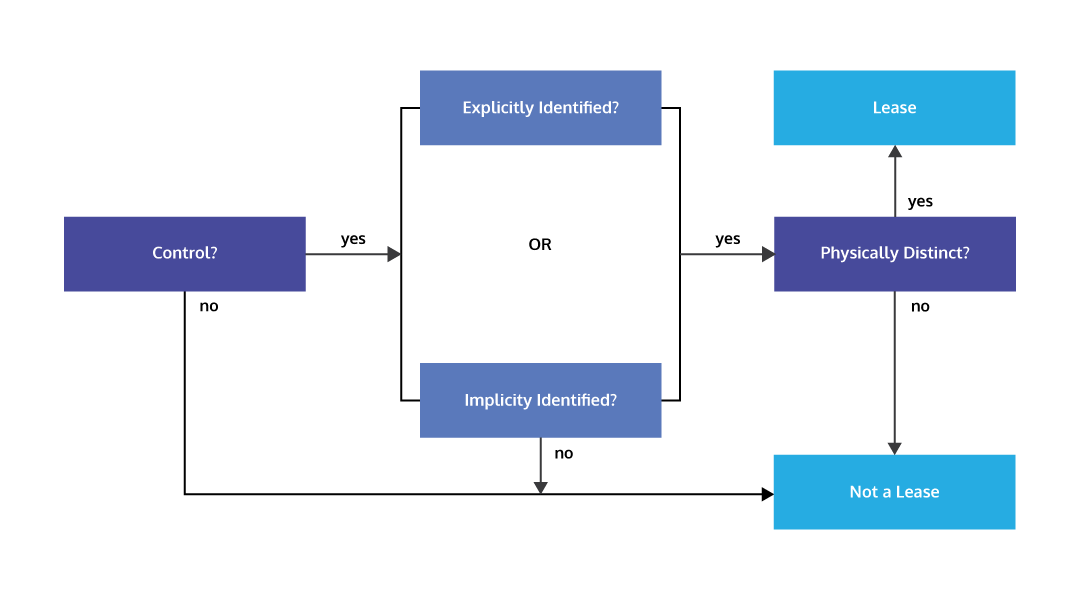

The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes.

. Open-end leases are generally blanket or master leases with multiple takedowns of equipment. Number of months 612 ie. Open End Lease TRAC Leasing If youre looking for a way to add vehicles to your fleet with greater flexibility you may want to consider a Terminal Rental Adjustment Clause TRAC.

O Contact legal counsel and explain the new terms for accounting purposes. In a closed-end lease the lessor takes on the depreciation risk. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the.

Currently lease payments made under operating leases ie non-financing leases are recorded as expenses on the income statement as incurred and nothing is recorded on the balance. Therefore its a capital lease. The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes.

According to GAAP Generally Accepted Accounting Practices capital expenditures are the acquisition costs for items that. Short-term leases contract term is for twelve months or less including options to extend will continue to be. They normally involve portable or mobile equipment that is clearly not special purpose to the.

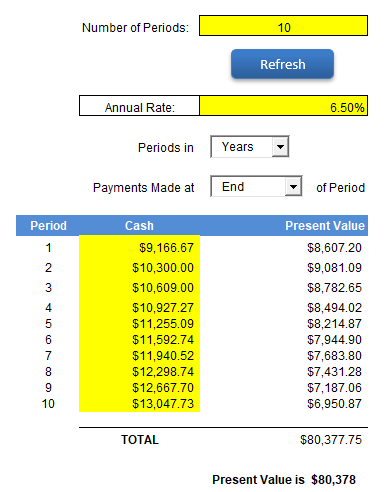

The present value The lease payment is 1033 which is greater than 90 of the assets fair value. A closed-end lease that is typically. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset.

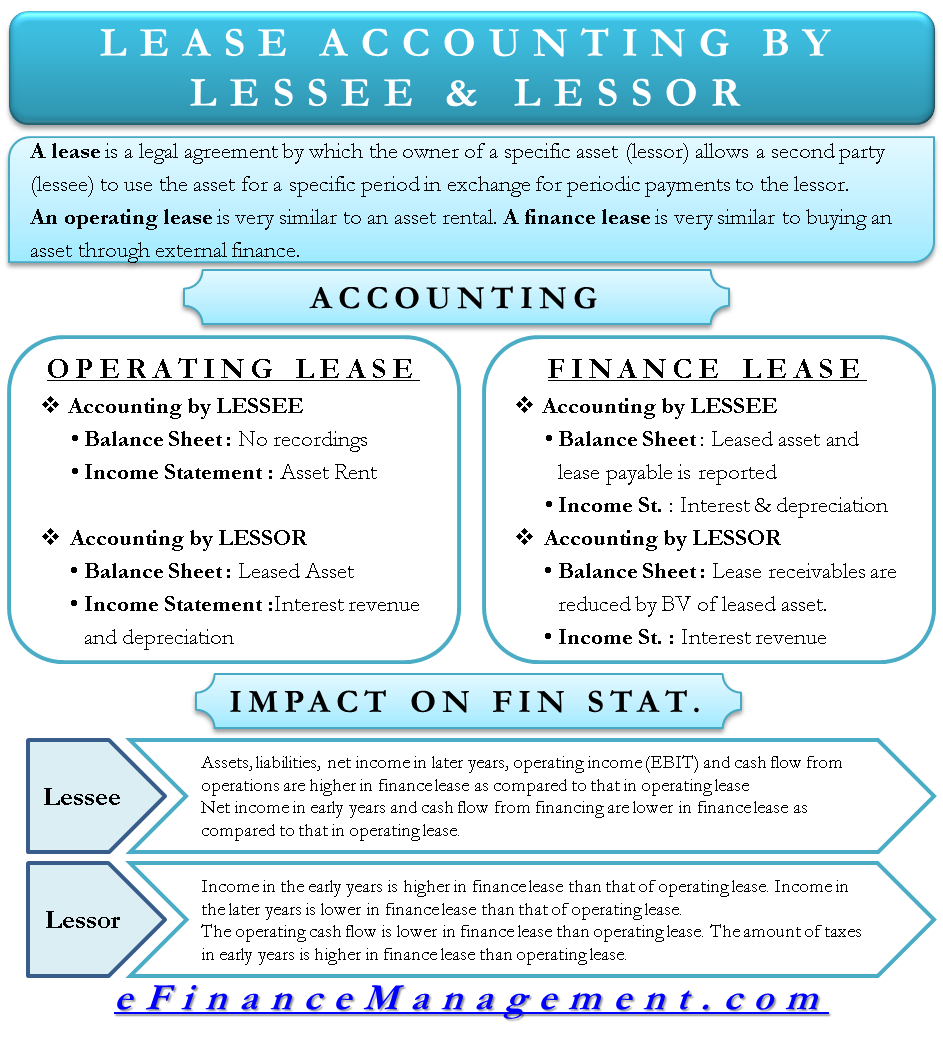

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

What Is The Difference Between An Open Vs Closed Lease

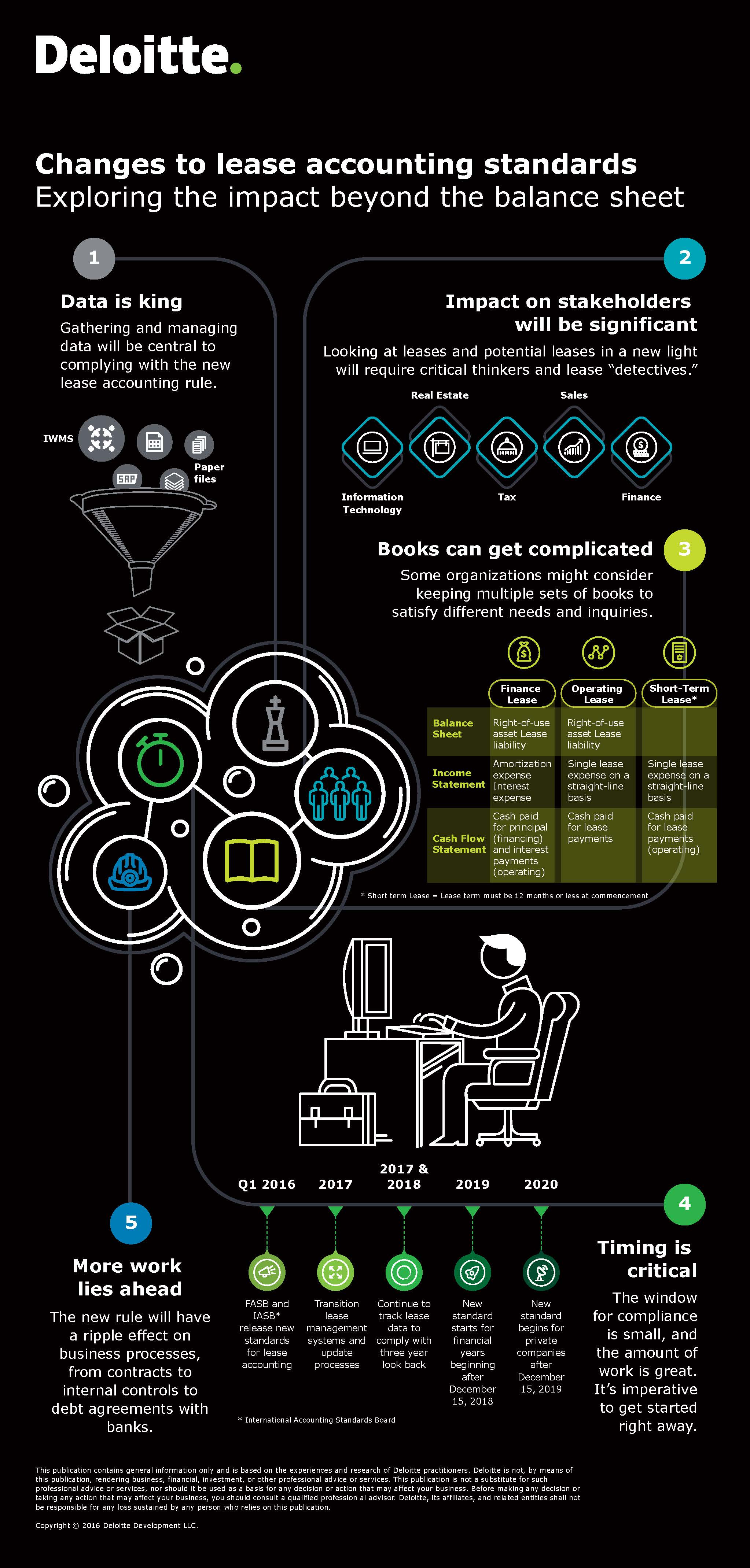

Lease Accounting Guide Roadmap For Asc 842 Deloitte Us

Lease Accounting For Lessors Overview Ifrs 16 Youtube

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Operating Leases Financial Edge

Changes To Lease Accounting Standards Deloitte Us

New Rules For Lease Accounting Wegner Cpas

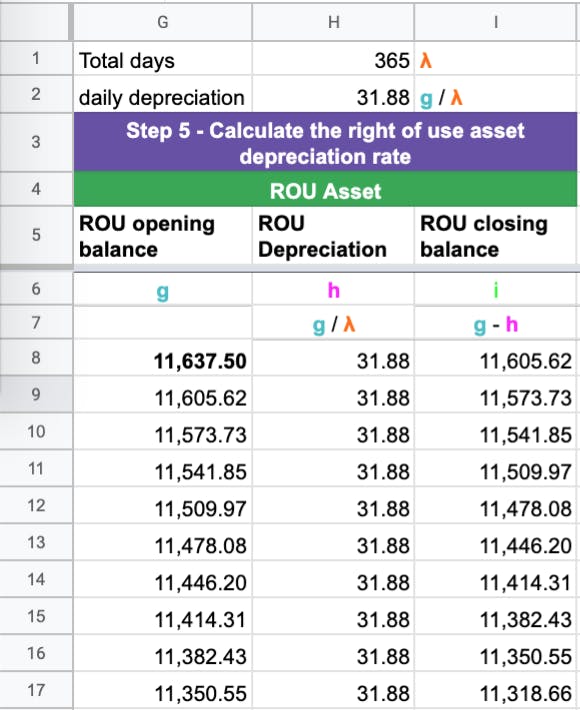

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Steps To Make Vehicle Leasing Mainstream In India

Operating Lease Accounting Double Entry Bookkeeping

A Refresher On Accounting For Leases The Cpa Journal

Gasb 87 Explained W A Full Example Of New Lease Accounting

The New Lease Standard Everything You Need To Know

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Regulatory Arbitrage In The Intersection Of Accounting Standards And Tax Laws The Case Of Synthetic Leases

Lease Accounting Standard Japan Leasing Association

Accounting For Leases Under The New Standard Part 1 The Cpa Journal